Thursday, July 19, 2007

Blogging Slowdown

Trade Wise, Trade Well

John

Monday, July 16, 2007

Continued NYSE Tick Weakness

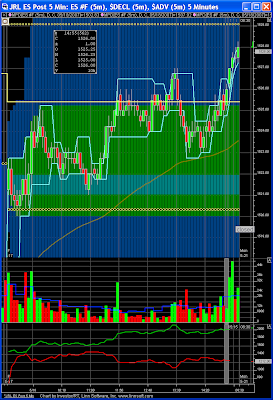

The NYSE Tick is continuing to display weakness that is not typical of the ES price action. I started to really like the filter capability of the Cumulative Adjusted Tick or CAT Indicator. My problem of recent has been that the continued weakness in the Tick is severe enough to produce CAT readings that no longer match the ES price action and reducing the value of this indicator as a trade direction filter.

I have been playing with some modified Tick calculations. Currently I plan on maintaining the original calculation for the CAT indicator. But the modified calculations help me "see" when weakness in the Tick is producing a bad filter reading. More research will tell me if the modified calculations will help filter my trade directions.

Trade Wise, Trade Well

John

Friday, July 13, 2007

Weak NYSE Tick Comment Link

"What the Weak TICK Really Signifies - We saw an absence of buy programs among

the Russell 2000 stocks, keeping the TICK restrained."

Some people feel the Russell dynamics could be changing. The Russell is known for nice trend moves that usually cover a greater profit distance than the equivalent move in the ES. As of recent, the Russell seems to not make these "extended moves" as often.

Trade Wise, Trade Well

John

Thursday, July 12, 2007

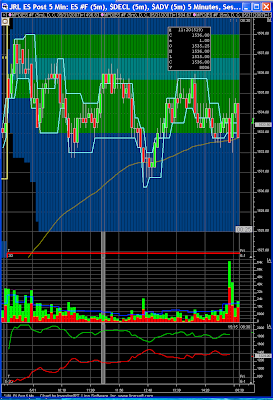

Interesting Internals

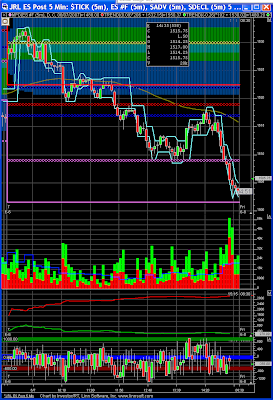

A real Gap and Go higher day. The NYSE Tick started strong but quickly fell back into a weak posture producing levels that would normally occur during a down trend in price. Not the case though, as the ES price kept powering higher for the majority of the day.

I found the market internals interesting today as well. My CAT Indicator was "Out-of-Synch" again for most of today. Similarly, the Advancing issues (ADV) and Declining Issues (DECL) in the chart below did not seem to match the ES futures price behavior either.

The Advancing Issues were relatively flat for the first 4 hours of trading while the Declining Issues kept increasing and increasing for the first 5 hours or trading.

The biggest decline of the day happened when price tested twice the first hours price range. The mystical 2X price of 1549 held initially and price retraced just below 1545. Then the ADV and DECL got in synch with the price action and produced a beautiful uptrend move. I caught the first half of this move. I knew I should have just walked away until near the close of the session, but I had to get cute with my stop and get chopped out (to the Tick) before price continued higher into the close.

Trade Wise, Trade Well

John

Wednesday, July 11, 2007

Here We Go Again? Maybe...

I did not trade today. Took some family time to to go see the new Harry Potter and the Order of the Phoenix movie at the local IMAX theater. I have liked other IMAX movies, but I left thinking I would have liked seeing this movie from a "normal" theater instead. I still would recommend the movie either way.

Back to the Charts - I found it interesting when I looked at the charts after the fact. Today would have been another "Out of Synch" day. To me, this means my CAT Indicator keeps telling me one thing (today to take short trades), but price is trending better in the opposite direction (today price was up more than down.

Since the July 4th Holiday, it seems to me that the NYSE Tick has been notably weaker. In the chart above, the Tick rarely touches the Green line. In a sustained up trend, the Tick will normally touch and produce extremes above this 1000 level frequently.

I can not wait until tomorrow to see what happens. Will we have a Gap down, will the NYSE Tick still remain weak, will it be a down day, or will price continue higher to the top of the channel we are currently trading in?

Time will tell.

Trade Wise, Trade Well

John

Makes More Sense Now - Delayed Post

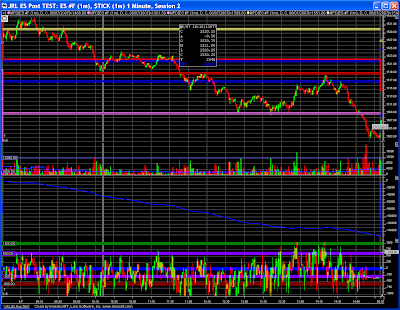

The NYSE Tick started out extremely weak. It took about 20 minutes for the Tick to get noticeably above the zero line. This weakness is not normal. Price did a "Gap and Go" lower. It was not obvious early in the day as price chop mostly sideways.

Combine today's weakness with yesterday's weak CAT Indicator readings and I started expecting a big down move was highly lickely and that price would not close the Gap. It took a ling time, but Price finally caught up to the CAT Indicator.

Trade Wise, Trade Well

John

Not What I expected - Delayed Post

I found Monday's trading out of synch most of the day. I'm fining my CAT indicator normally keeps me on the right side of the trend. Caught the first breakdown, but the ES price kept grinding higher while the CAT indicator was showing a weak day that usually would produce lower prices.

Just goes to show you that the market WILL do what it wants and not always follow the indicators. :-)

Just goes to show you that the market WILL do what it wants and not always follow the indicators. :-)Trade Wise, Trade Well

John

Tuesday, July 3, 2007

Thursday, June 28, 2007

Did It Again

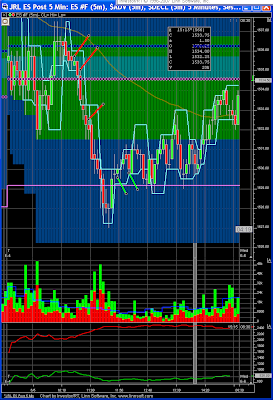

Today the CAT Indicator kept driving higher up until the FOMC Meeting, but price was choppy and driving sideways for the majority of this time. This is another case of price having to "catch up" to what the CAT Indicator is predicting to be happening. An earlier posts shows this happening to the short side and today was a good long play example.

I still need to do some more research to verify that this is not just a recent phenonmenon. But I find this a very interesting and so far a reliable clue towards price action produced from the CAT Indicator.

Trade Well, Trade Wise

John

Wednesday, June 27, 2007

Buy, Buy, Buy

Buy, Buy, Buy is what the CAT indicator said most all day today. There was an initial dip below zero off the open. It is hard to see in the compressed 1-minute chart, but it was all up from that early CAT low. Every dip in price high showed a higher low in the CAT indicator.

Now if I just listened better, I would have had a much better day. I must figure out why I end up fighting the trend as much as I do.

Now if I just listened better, I would have had a much better day. I must figure out why I end up fighting the trend as much as I do.Trade Wise, Trade Well

John

Sunday, June 24, 2007

Late Post

Friday the 22nd of June, 2007 ES Futures

I found it interesting that the NYSE Tick was very weak Friday. This weakness showed in my CAT indicator as it just kept driving lower all morning. Notice in the following 1-minute chart how the purple line for the CAT stayed much closer to it's down trend line than did either the ES price or Mini ADV indicator.

At the low of the day, all the values were back around their respective trend line drawn off of the lows mad early in the morning.

How Did it Go

I'm still taking too many trades "late" in the move. If I pass on a signal or just miss a trade opportunity I have a really bad tendency to just enter a trade "hoping" the move keeps going. First of all - there is the "Hope" word using to describe my trading. I must get the "Hope" out of my trading. These are not "signalled trades" but I'm having a hard time eliminating this trade for some reason.

Need to Keep Score

50% cost me 1 - 2 points

25% scratched out at break even (still cost commission)

25% profited 1 or more Ticks with one (only one) profiting 1 point

Need I say this put a big dent in profits for the day.

If I entered a counter trend scalp trade and traded the opposite direction of these trades, I think every one of these would have held an initial 1 point stop and hit a 1 point target. I'm not planning on trying this, but I can show this over and over again, but still have troubles not taking this trade. This will change.

Trade Wise, Trade Well

John

Indicator Issue Fixed

I like how this filter indicator seems to support the indication of turns in the market. Still more research to do.

Trade Wise, Trade Well

John

Thursday, June 21, 2007

Indicator Update

I had a good day today. Still not capturing all that I feel I should, but I feel like I'm getting back on track. I need to start keeping score based on the number of "good signals" I take and the number of times I try to "jump on" a trade late. Based on my track record, I am far better off fading the move for a 1 point counter trend scalp trade than I would entering the trend trade late with a 1 - 2 point stop. I respect what FlatWallet is doing keeping score on a two week count down to consistently follow his method. I should come up with something similar for my discipline.

What about the Indicators

Thought I'd share an update showing my two filter indicators CAT (Purple) and Mini ADV (Blue). Thanks go to Dr. Brett for inspiring these indicators. The CAT is a copy of his Cumulative Adjusted Tick, and the Mini ADV is a twist I created based off of his Relative Dollar Flow. As you can see in the following 1-minute chart of the ES for today, both of these indicators tracked with the trend fairly well.

The CAT mimicked all of the swings the best. But overall showed more weakness today than is reflected in the actual price action. Turns are more often than not signalled late as well.

The CAT mimicked all of the swings the best. But overall showed more weakness today than is reflected in the actual price action. Turns are more often than not signalled late as well.The Mini ADV signalled the turns much better. I added yellow vertical lines to compare the turning points through the chart. Several of the turns were double tops or bottoms and I only highlighted the candle with the most extreme tick reading of the two. Mini ADV either "turned" at the first top or bottom or "turned" between the two.

I need to do a lot more research with these "filter" indicators. They did help me today to stay with what seemed like the constantly changing trend. I specifically want to figure out why the Mini ADV did not represent the first swing lower.

Trade Wise, Trade Well

John

Mini Advance Decline

For fun I took Dr. Brett's stocks used in his Relative Dollar Volume Flow and made my own Mini-ADV. I trying out an indication of Up or down from the Open.

How Does it Work

I need to do more research, but I find it interesting so far. Notice the high in the ES Futures at 9:45 CT. The Mini ADV is the blue line at the bottom of the chart. It was working its way lower. Time will tell.

Remember

This is not a new "magical indicator" to pick trades. This is just a potential filter tool.

Trade Wise, Trade Well

John

Friday, June 15, 2007

Took a Break

I needed to do the same thing this last week and I'm trying to decide if I'll continue blogging or not. For the immediate future you will see a reduction in the number of posts as I work on some more Trader Feed indicators and spend more time on my trading statistics.

Trade Wise, Trade Well

John

CAT Indicator

I have my current implementation for Dr. Brett's cumulative adjusted tick indicator that I refer to as CAT. Quick background - CAT is a running total for the current day of the 1 minute NYSE Tick close value that has been adjusted by the average Tick value for the past 20 days. If you are an Investor/RT user let me know.

Not Exact

I had been unable to match Dr. Brett's values as shown in his May 24 post and parked the indicator. I decided to dust it off this week as I have been looking for an indication of trend days to help hold for the bigger moves.

My values still don't match exactly, but are "close enough" for now. You can see how my indicator crests just over the zero line before showing a nice down trend on May 24th, 2007 below. Dr. Brett's indicator never goes above the zero line the entire day.

Other than the differences in the values, I do like what I'm seeing from this indicator. More historical research is needed to see how this reacts in different market conditions.

Other than the differences in the values, I do like what I'm seeing from this indicator. More historical research is needed to see how this reacts in different market conditions. Sample Charts

Down Trend - May 24th, 2007 and June 7th, 2007 are remarkably similar days and show how the CAT behaves on a strong down trend day.

Choppy Day or Mixed day - Today's chart, June 15th, 2007 is a decent sample for a chart that has mixed up and down trends with some choppy periods as well. I found it interesting that the CAT showed a trend into the close, but that price did not follow through.

Thursday, June 7, 2007

Have You Ever Noticed

The following charts display two examples from today's (June 7th, 2007) price action that I'm always trying to be on the lookout for in price action. I have to say I'm just beginning to trade them properly.

Well get to it already

Just before the big moves are made, the market does the best it can to shakeout and fake out as many people as possible. I dialed into the 1-minute chart to show more of the price action.

Notice the nice methodical "Stair Step" down pattern was from the double top high after 9:00 CT down to what could be a double bottom low at 1527. The second low comes in right at 9:30 CT. Then the market moves up above 1528 and does a head fake lower to get some more shorts to jump in.

Then there is an abrupt detour in the down trend and price drives straight higher. We make another top at 1530.50 price. I'm actually surprised that we did not go at least 1-tick higher as I'd expect some people had stops above the prior 1530.50 high. Enough people must have moved their stops to 1529.50 area. Would your have left your stop 4 points above and stayed in this down move?

Then note what happens on the way back down. Price hesitates at 1529 for those people that want in of this "up trend" we just had. Then price presses a little lower. The people long at 1529 are now "hoping" for price to come back higher and I'm sure a few more people get long at this "better price" before price is crushed down past the prior lows.

Also Note

Be sure to note the high in the NYSE Tick when price drives back up to 1530.50 just before the big drop. The Tick made a "higher high" when compared to recent Tick highs. This could mean a turn back higher, but also often signals the big "stop run" before a return to the prior trend. It is our job to figure out which one is being signaled.

Look at how complex the bottom is before the market goes nearly 10 points higher. The first low is 1509.00 at 12:42 CT. Then we have step one higher to 1512.50 at 12:47 CT follow by the retracement down to a potential "higher low" just missing 1510 at 12:49 CT. Now notice the 12:51 CT and 12:52 CT candles. A quick slam down and back up again for anyone wanting to get short as there has not yet been a "higher high" yet that may keep some people from getting short.

Price grinds higher to the 1513.50 high after 13:00 CT. Then the move down seemed to me to be a pop up in price followed by a quicker slam lower until we made a lower low. Then price went up 2.5 points, back down 2 points, up 2.25 points, back down 2, and then up 3.25 points. In this big of a down day, who would hold through all of that to catch the long move higher? I did not play in any of that chop.

Look what happened next. Price comes down 3.5 points. 1 Tick lower the the last of the three lows described above. I tried to to get long this last time down.

You What?

I tried to get long at 13:36 CT. If you look at the 5-minute chart, the 13:35 candle had lower over all volume. Call me crazy, it looked like I should try it. Well I did not get filled. Looking at a faster chart (not posted) price dipped below 1510.00 @13:36:23 CT, touched 1509.00, and was back above 1510.00 at13:36:38 CT. I had 15 seconds to place my order. Actually I tried for 1509.50 and price was only below for 5 seconds. I could have gotten in at 1510.50, but that is where I would have taken off my first half trying to let the second run for more profits. With only a few hesitations for people to get short at, price drove straight up 6 points.

Hope that makes sense. Let me know if I should mark up the charts more and what you would like to see as mark ups to help better describe the price action.

Trade Wise, Trade Well

John

Extreme Weakness

How Did it Go

Better, but still not where I want it to be for a day like today. I caught a couple of the down swings and actually make some profit on a couple long trades too. But I still can do better. As weak as the NYSE Tick was today, I should have shorted anything that even looked like a top.

Why was my game still off today. The price action felt jittery or jumpy to me most all of the day today. I seemed to get transfixed with the jumpy price action and did not focusing on all my tells like I should. It started when I just missed the rocket ride to the long side early in the morning. I took me over an hour to adjust and get a good feel for today. Then I still felt a step behind on many moves.

This is a little hard to see in the 5-minute chart but try to follow along. We start by looking at the double top between the 8:50 CT and the 9:05 CT candles. The 5-minute chart then hides the pull back as it is split between the 8:50 CT and 8:55 CT candles. Leaving both 5-minute candles looking Green or up moves.

But notice the volume after the first top. Big drop in volume and reduced again in the 9:00 CT push to the second top. What you did not sell the top, there was 5 minutes to sell 1532.00 or better. Well I saw it, and decided not to trust that signal as we already shot up 4 points on almost unbelievably weak NYSE Tick readings. I added to the 5 minute chart for reference.

Normally I'd expect to see NYSE Tick readings touching the green horizontal line in the chart for price to move significantly higher. See how the first near touch at 13:30 CT started the afternoon long trend.

Next, the 9:15 candle's volume screams short the next turn down. I should have taken it, but the NYSE Tick was so weak that I was waiting for a slight push higher before I shorted. My Volume Delta indicator tried to tell me that was all I was going to get for the move up. I was still trying to get in sync with this very "different" day.

Trade Wise, Trade Well

John

Wednesday, June 6, 2007

One Step Forward, Two Back

How did it go

Don't ask... I traded very poorly today. Volume started out good and gave the appearance of a trend day fairly early. I lost count of the number of signals that I should have taken. They all would have been profitable to varying degrees and some were even long trades in the afternoon.

I did get a couple of profitable trades, but gave it back chasing entries on trades I did not get in at the signal.

I really need to start trading my system. In the long run, I will be far better off just trying the confirmed entries with the trend. I'll more than be able to give some profits back on the choppy days as days like this will more than make up for it. Assuming I trade them right.

Note the Volume Tells

Check out the lower volume on the early green 5-minute candles. Especially the 3rd, 5th - 6th, 11th - 12th, 15th, and 27th candle on the chart. They all helped to confirm 4 short legs on the initial press lower. The final was a clue to catch the last half of the second big push ;lower in today's Gap and Go price action.

Then we had the opposite for the 11:15 CT candle: Red candle with lower volume - Time to get long.

Then a harder one. The 11:35 candle with really light volume. But also notice the increased selling volume in the prior candles. I saw it, but instead of getting in, I wanted to see price press closer to 1522 again. This second move down was ugly, but volume was trying to coax me in. I just like to see a better rallies to short into, but I'm starting to be a broken record about not taking signals in tight sideways chop.

Later in the afternoons I often find it difficult to use the 5-minute volume as we seem to be more apt to chop around and the read is not as clear as in the mornings.

Trade Wise, Trade Well

Someone needs to as I have not been recently

John

Tuesday, June 5, 2007

Baby Steps

How did Today go

Today was not a banner day for me. I ended up positive, but I definitely needed to take some "Blind Faith" trades to make today deliver the results I would have expected for today. I had four occasions where I found myself saying I should be in a trade, but ended up watching anyway. See the Red lines (first two) for short trades and the green lines for long trades.

I think I'm being overly judgemental about my entries. Last week I found myself chasing price after taking too long to decide that a signal was good. When the market is not trending, chasing a price swing ends in a scratch trade 80% of the time and that requires me to "give up" on the trade before price retraces and would often hit my stop for a small loss.

I'm also trying to press myself to take the signal at the "right time" or to let the trade go after reading Dr. Brett's comments about the replies to his Coaching Project and today's Discipline post. If I had to place myself in one of the categories Dr. Brett describes in the Discipline post it would have to be the volatility category.

It feels weird to me to say the cause to my discipline breakdown is volatility. But I can make an association. The signals I'm passing on too often are tight coils where price often moves sideways for 10 to 15 minutes. Today's first short example fits this to a tee. Price went down 9 of 10 points before we had a rally of more than a point. I had several "confirmed short" signals but passed as I always felt I was shorting the low.

I think a mental association with shorting the low is more apt to be the cause. I feel I built this association by "chasing" entries late. Since price often moves in surges, a late entry will more often then not comes at or near the next "counter trend" signal in my system. Then price usually retraces enough that I have a hard time justify holding on to these trades. On a choppy day, these surge moves are often the head face before price turns back into the chop.

But now I'm in a catch 22. My discipline problem is caused by a discipline problem... Err, lets not go there.

I will say watching the 5 minute volume helped to keep me from taking some counter trend trades. Starting with the first Red candle of the down trend (just before the second high in the double top) at 10:10 CT we had light volume followed by an increase in volume as the trend started down. Then the 10:20 CT candle had lighter overall volume, BUT note that the "Sell Volume" as indicated by the Red portion of the volume bar increased from the prior bar even with the lighter volume.

This afternoon, I found Volume to be a much harder read.

Trade Wise, Trade Well

John

Monday, June 4, 2007

Under the Weather

Did not trade Today

I was up sick too much last night and decided it would be better if I did not trade today. Feeling better in the afternoon, I opened up the charts to see what I missed.

It does not look like I missed a lot. Price spent most of the day in the 4 point Value range defined Friday. Note that we had another one of those interesting days where the Volume Breakdown Accumulation works it way lower while price works its way higher. The last time this happened, while I would not have expected it, we had a nice rally the following day.

I believe when we see this happening that the large players are "lightening" or reducing their long positions some. They just are not being aggressive about it. This has not enhanced any edge for me at this time.

Trade Wise, Trade Well

John

Friday, June 1, 2007

Blind Faith

Spotlight Trade

I have been reviewing my trades even harder recently. I review the trades I have taken and compare the entry timing of my trade with the trade signal. I also consider signals my system has given, but where I did not take the trade. I discovered a consistent theme of trades that were profitable, but I was filtering out the signal and consistently not entering these trades.

When I received a signal while price was "ledging" sideways, I would not take these trades vary often. There was a short trade earlier this day that I should have traded but passed. So when this trade occurred I was more determined to "believe my signal" and take the trade.

To see this pattern, start at the low at 11:50 CT. I had a "counter trend" long signal here but focus on trend trades until I have built up more profits for the day. From this low there was a nice price rally higher followed by a retracement back down to the 1535.00 price.

One quick tag of 1535 and price shot up above 1536. My entry signal came on the 12:08 CT pop higher. Initially I thought I had a "run-away" where the possible trade entry price was too far from the signal. Then I felt that price was "ledging" sideways. Some people call this sideways price action a coil or shelf. Still others would say this is the right shoulder of an inverted head and shoulders pattern. The low being the head in the pattern.

I entered at 1536.00 still having my doubts. Then price did a quick press lower towards 1535 again. I thought to myself here we go, the market wants to test my stop and see how much room I'll give this trade to survive. Then even faster price shot higher again. Can you say blast off!

My first half was out at 2 points. When price seemed to stop pushing higher, I only allowed a few ticks and took the remaining profits off at 1.5 points. I was so elated that I took this trade and it worked that I missed the re-entry at 1537.00 as price retraced back down to test the "launch point" and only rally back up to the swing high point.

I don't usually look for head and shoulder patterns as a part of my trade signals. I only noticed this pattern when I wrote this blog entry. The standard H&S target, from the head to the neckline, was not reached. I would have liked an extra point for my second half of my position. :-)

Trade Wise, Trade Well

John

Thursday, May 31, 2007

Good with the Bad

Spot Light Trade(s)

See the three circled areas for today's spotlight trades.

Why would I do this? There are some subtle clues. The Volume is really light compared to what is expected. But if you look at the 5-minute volume, the "heavier" volume candles are the Red candles. It is hard to say heavier when the volume is this light, but a warning sign.

Tight Price Action

How did it go today

The 5-minute chart does not do the price action justice. Most of my entry signals for today came while price was in tight sideways chop. Notice in the light blue lines in the 5 minute chart below. These lines defines my calculated "immediate trend" that tells me the direction to focus on trades. If the lines "stair step" lower, I look for short entry signals and if the lines "stair step" higher, I'm looking for long trades. As you can see, there are not many steps in the same direction today.

Wednesday, May 30, 2007

Ten Rounds

How did today go

The title of this post says it all. I feel like all I did was fight the market today. I need to figure out why I fall into this ruts where I fight the market and worse yet... fight what my own system is telling me to do. I took more trades than I should have today and too many of them were short trades.

Not good when the market goes up 20 points. Chalk up another day in the not what I should have made today category. Today's price action seems to consolidate sideways for 10 minutes then pop up or down quickly in just a minute or two.

My bias last night was to watch for a potential trend day for the end of the month. Well... we got a trend day. I normally try not to have a bias and just trade the price action. I guess I did too good of a job clearing my head of any biases.

Struggling for a good spotlight trade to present for today. I'll see if I have more time later tonight.

Trade Wise, Trade Well

John

Tuesday, May 29, 2007

New Style - Spot Light Trade

Trying to be more brief - let me know if you like this format or the long style with more details.

Thursday, May 24, 2007

High Volume Day

Wednesday, May 23, 2007

How Long Can We Trust That

That makes three days in a row where we have sold off hard in the afternoon and closed near the low of the day. Did you expect it again today? I did not think it would repeat this many days.

BUT...

I can not prejudge and decide what the market will do. I need to follow my trade signals to stay on the proper side of the trend and jsut see what profits follow. The first long signals early in the morning worked great. Then the anticipated pull back from the initial highs. From here, I wanted the market to blast to the moon.

I talked myself into a scenario where the market just could not sell off a third day in a row. This just has to be a fakeout. Make price action look like we are setting up for a selloff, then blast higher.

Well I did not get killed, but I scratched out of too many long trades at break even, longing for more profits, instead of harvesting the available profits. Worst of all, I was "looking the wrong way" and did not take trades with the trend. I saw my short signals, but did not "want" to listen. So when my long trades got stopped out, I'm not short and end up watching the move go without me.

Today should have been an awesome day with profits that some people would think of as unbelieveable to obtain for one day of trading. Instead, I'm left disapointed at my trading. From now on, I must take the trades and let the market "show me" what it is going to do. I'm killing my profits "wanting" or "Hoping" the market does what I decided.

Trade Wise, Trade Well

John

Tuesday, May 22, 2007

It Happened Again

What is it

Today's high came in at exactly twice the first hour's price range again. To the Tick. You can see this on the chart as the top of the Blue background represents twice the price range from the first hour of trading.

Wishing I shorted it just for fun, but I did not. I need to consider adding rules to get me more aggressive at price levels like this.

Right now I protect unrealized profits or even take profits just below these key levels. But I do not reverse or short these levels just because they are on my chart. I do have to admit that I'm often watching good trades go by that occur at or near key levels like the hourly range and twice the hourly range. Other key values include the Pivots, R & S values, and the Market Profile levels.

Trade Wise, Trade Well

John

Bad Moves

How did it go

Got off to another bad start again today. I chased some trade entries when I should have just "thought" I missed the entry. Then I would have been glad I missed the entry watch price come back the other direction.

So once again, profits were eaten into by mistakes I should not have made.

The Chart for today will be in the Next post.

Trade Narrative

I have not heard from many people yet about this blog, I don't suspect there are a lot reading yet, but I'd love to hear from more of you. I'm trying to figure what level of detail to place in this public journal. Let me know. For now I'm switching more of a summary than I have used in my earlier posts.

Don't do that again - My first two trades I have to describe as "Chase" entries. This is where I enter late after the signal and can be as much as 1 point from where I feel the Signal triggered an entry. I was questioning the entry signals early as the volume was noticeable below the average expected volume for most of today. This light volume should have told me to ONLY take proper entries or wait for the next signal. My best entries can come a minute or two after the signal, but waiting for a better entry can also leave me out of the trade as well.

I took it easier and did not trade much more in the consolidation range that lasted for the first hour and a half of this morning's session. Saw some counter trend trades, but my rules have me on the sidelines until I have profits to risk against these trades.

Bought the Low - I felt a little better when I bent my counter trend rule and took a long trade near 1526.00 after 11:00 CT. This turned out to be the low of the day. I just saw a "big push" lower that only made a quick 2 tick lower low before price popped back up. On "low volume days" I like to fade the extreme moves. That is as long as we do not appear to be trending. Now if I just held on to this entry longer. I took some earlier profits, trying to make up for my first bad trades. My thought was that I'd reenter, but there was not a good entry until price had gone 5 points higher.

Hard to balance between "taking profits" and "letting profits run" and be right all the time. I just need to figure out how the market seems to make me feel that I get this wrong more than I get it right. :-)

Lessons Learned or Still Needing to Reinforce

Several lessons from today.

- Treat each trade separately - do not try to force one trade to compensate for prior losses.

- Do not chase Entries - I have told myself this before, but I keep chasing what I "want" to be a run away move. Not going to happen with low volume.

- Re-evaluate the Counter Trend Rule - On low volume days, I think I'll have to be more willing to take trades that are defined by my system as counter trend trades. I normally try to avoid these trades when I don't have profits built up for the day to risk on these trades. When price is chopping in a range, good signals occur on the edges of the range, but these is no real trend.

John

Monday, May 21, 2007

There it is again

Notice where the Highs came in today?

If you did not see my earlier posts on this observation, I wanted to point out that it happened again. This time it was the High of the day instead of the low.

What is it?

Today's high price was almost exactly twice the range created within the first hour of trading. This can be seen by the Blue background that appears on my chart. Price could only get two ticks higher.

This was a big resistance area. R1 was 1533.00 and I also had Market Profits Targets just above 1534.00 as well.

Trade Wise, Trade Well

John

Charting Issues

How did it go

Got off to a bad start. My charts decided to give me grief this morning. For some reason Investor/RT (IRT) does not like one of my charts. My chart that breaks candles down for every 1000 contracts traded has been giving me troubles off and on for too long now. This is the chart I use to help time my entries. This morning my Volume Break Down showed no values for the last few days and the start of the morning.

I tried to fix the problem and ended up missing just more than the first hour of trading. Big mistake as there was still good price movement today and I let theses issues throw me off.

Trade Narrative

Just missed it - I missed two long signals at better than 1528.00 entry price. The first signal would have finished as a profitable trade. The second signal was showing signs of working too. I was not real excited to join the trade late over 1 point above the entry as price action seemed quiet with lighter than average volume. I was trying to decide if the up tend was going to continue and I missed another entry as price ticked through 1528.00 and continued higher.

I was starting to decide to not trade this "light volume" price action and missed a couple of good long price swings. Frustrations with my charts just before the session open got the better of me today.

Lessons Learned or Still Needing to Reinforce

I should not have let myself get drawn into trying to resolve what appears to me to be a bug in the chart program I use. The issue only effects history and has been working for new real time data added to the chart. Save these issues for after trading hours.

Still, I should have better trusted my signals and got myself back on track. I would have had a couple of good trades late in the morning. I backed off for the day as my mistakes tend to be made most often in the midday and afternoon portions of the session. This means I need to focus in the early morning to build initial profits for the day.

Trade Wise, Trade Well

John

Friday, May 18, 2007

Limited Screen Time

Today went great. I was doing "my fatherly duties" today and did not have much real-time chart watching. So it was good to spend some time with the family and get a break from the charts. Here is a 5 minute chart to review how the day went.

I was around to see the market open. I was trying to decide if I was going to take any trades today knowing that I'd be away from the screens more than I'd be able to monitor the price action and my trades.

I don't have many entries right off of the open. My setups rely on current price action and sentiment to develop before I fell I have a high probability trade setup. I was really interested in shorting 1522.00 just off of the open, there was a nice pattern in my Volume Break Down Delta telling me to go short.

The trouble is that this pattern can quickly flip back to the long direction so I like to see some price action to go with this signal to be more confident I'm entering with the trend and not just catching a quick retracement in price.

I did short at 1521.00 to probe and see if the initial down trend was going to continue. My first half did not fill at +1 point. I knew there was a 9:00 CT report coming and my objective was to try and have a "free" trade with the second half of my position in case price breaks hard down from the report. When price stalled, I took half off at 0.75 points or three ticks. Normally I would have held, but since I had to leave before the report hits, I made a compromise. I needed to get out the door and price was starting to inch up at me so I placed the stop at break even and left. I was confident that the stop would be hit just a couple ticks way from price. Maybe I should have just closed the trade. Either way there was not a big difference.

From this point on, I had just a couple of times where I had the chance to "check the charts" to see what I had missed out on. Each time I looked it seemed like I had just missed my entry, price was still close, but the trade was a counter trend trade.

Shortly after 9:30 CT I really really wanted to short 1525. I had a major cluster of resistance there. The R2 value I had at 1525.50, I had a Market Profile Target at 1525.00, and a second possible Market Profile Target at 1526. We just have to get enough of a bounce off of this price area for a small profitable trade.

I should have noted the entry price I could have grabbed as I sat down to the screens. I passed and watched as price did work its way lower then channel tight sideways before I was off again. This trade should have been good for 2 points and 2 points for each half the way I trade.

This time I was gone longer than I expected. I returned just before 1:30 CT. It was a quick read, but I could still get short just under 1527. I decided that I have a bad track record for trades I "instantly" identify at first glance after being away from the screens for a period of time. Passed again. Another possible 2 - 3 points

The afternoon looked like it could be flat to slightly higher. Well... make that a close at new highs for the weekend hype. Should have thought about that, but decided just to observe.

Lessons Learned

Don't over do it - make sure you get some time away from the charts every now and then. I think I was over due for a break.

Observations

Another choppy day. The price action yesterday had better defined "micro trends" on the 5 minute chart as defined by the light blue lines around the price action. Today had consolidation periods where the "upper trend line" went lower and the "lower trend line" went higher.

Today seemed easier to trade, but did not offer the same profit potential. Granted I was not there is real time like I normally would have been. Let me know what you thought trading the ES was like today. Did you stay awake and focused through the consolidation to catch the moves?

Trade Wise, Trade Well

John

Thursday, May 17, 2007

Interesting ES Volume Fact for today

Something happened today that threw me off track and helped shift me into taking more Short trades when my trend indications were actually saying "go long." This was the Volume Breakdown Delta Accumulation indicator. For those that do not know what it is, it is an indicator that can categorize or break down the volume traded to show if there is more buying pressure or more selling pressure.

Background

In the chart below I have added two versions of this indicator that I will reference from time to time in my other posts.

- Volume Breakdown Delta - The difference of the buy and sell volume for the current candle.

- Volume Breakdown Delta Accumulation - A running total for the above VB Delta.

I use the Up Tick and Down Tick option instead of the Bid and Ask option to calculate my Delta values. Both options produce very similar results, but I have found the Up Tick and Down Tick to suit my tastes better and provide fewer "fake out" moves. Usually the Delta Accumulation tracks reasonably well with price action. Meaning both values will make higher highs or lower lows together. When there is a difference or divergence, I feel the Delta often leads the price action in the turn. Nothing is 100% and focusing on the "short term" can be misleading if you don't also step back and compare with the "bigger picture" of price action.

Slam-A-Rama Day

How Today Went

I'd have to say today was a hard day for me to trade. I'm still struggling to terminate some bad habits that have resurfaced and hurt my trading the last couple of days. Combine that with the choppy back and forth price action and it was easy to find yourself on the wrong side of the "micro" trends in the day.

Volume started out lighter than the 15 minute average. So the choppy price action was not a surprise, I just did not compensate for it in my trading. I had a good start catching an early short that started working right away. That is until I tried to let the trade run, it did not. That sets the mold for my trading today: Trades I let run did not and trades where I protected profits stopped out for little to no profits before offering additional profits.

Trade Narrative Summary

My trade setups take some price action in the current session before an entry can be defined. Some days a setup can form sooner than others. What I need to do more is look to my 5 minute chart for clues to the "micro" trend direction. This is the direction that I should be placing my trades in until I have some profits to risk for a counter trend trade entry.

So to attempt to make this talk through faster, I'm just going through my 5 minute chart for trend changes. You can see these trends as the light blue lines draw on my chart. By 8:50 CT the initial trend was defined as leaning down. It started real slow, but ran for a couple of points of potential profits. Then there was an up trend after 9:00 CT. Or should I say the reaction off of the Leading Indicators report that was released then.

Coming up on 9:30 the third "micro trend" was turning back down and then right back up again around 10:00 CT. Price spiked up over 1519 and quickly reversed. The one minute chart was warning about the trend change first and the 5 minute confirmed about 10 minutes later.

A little after 12:30 C T the sixth micro trend of the day was back up and held to the high of the day. The volume from 12:55 CT through 1:15 CT was very light, but building. The direction "Tell" was muddied because both the declining and the rising volume was increasing.

Our final trend was back down. There were some early warning signals that the high may not hold, but the trend was finally confirmed down by 2:30. I took a good short entry as a counter trend trade, but did not manage to hold long enough and was knocked out for a small profit that could have been 4 to close to 6 points if held late.

Lessons Learned or Still Needing to Reinforce

Quick list for today.

- Maintain Focus Better - Today was not a day to lose focus as the market would turn as soon as you looked the other way.

- Don't Force or Chase Trades - In a choppy market there are often multiple chances to get into a trade. Don't rush into a trade at a less favorable entry price.

- Watch ALL the Clues - I need to train myself to keep "cycling" through a review of my charts to help make sure I'm seeing all the continuation and warning signs. For a choppy day like today, the warning signs of a potential turn are critical times to protect unrealized profits and tighten stops if appropriate.

- Have a list of Report Times - As a pre-market ritual, I'll review when major reports are coming out for the day. I do need to be better at watching the clock for these times. Maybe I need to set an alarm as a reminder. When the Leading Indicators came out I should have protected my profits in my short trade and possibly tried a scalp entry long to see if it would hold.

John

The Hardest Part of Trading

I know I sure did. I felt I was a "level headed" individual that did a great job at keeping my emotions in check in everything I have done in my life. Well let me tell you for some reason trading is different. I'd also have to admit that I was great at keeping my "outward" emotions in check. So I would appear calm and collected in difficult or emotional situations, but the emotions were still inside trying to cause me issues.

What Got Me to Focus on This

Last night I was looking through some Blogs that I don't normally visit. I was not really looking for anything specific and at the time I did not track these blogs as they did not seem to complement my trading style or needs. But I discovered a couple of comments that stuck in my brain about the "Pain of loosing Money"

- For most people the pain of loosing is greater than the joy winning the same amount.

- Making losses is painful enough. Especially if you knew better and could have avoided them.

How does This tie to My Trading

I can say that I had a big problem "over protecting" good trades where I would crowd the stop too quickly and placed it at break even just before the trade goes my way. Because of the fear of a winning trade becoming a loosing trade. When I have not even given the trade time or room to work for me. On the flip side, I had had no problem holding onto loosing trades, "Hoping" that price turns and the trade becomes a winner. Only just delaying the loss until the stop would get hit when I should be evaluating if I should be in the trade and exiting as soon as I determine the trade is not what I wanted. Or at a minimum, checking where the "tightest" spot I can place my stop that still allows the trade a small chance to turn into a winner.

For some reason this all came together as I reviewed Dr. Brett Steenbarger's recent Post. I followed the link to Dr. Bruce Hong's new Blog. While reviewing his posts on trading Psychology I came across his post on The Beginning: How memories are formed and it really struck home for me. Dr. Brett had spoke about the need for repetition to really learn or ingrain a habit into your brain to get to the point where you react the same way each time to the same event. While it made perfect sense to me, it never combined with my bad habits I needed to break.

My recent frustrations with my trading the last two days needed to combine with this information. The following quote from Dr. Bruce's post is what struck home for me:

"Good habits and skills take a lot of time, effort and repetition to acquire. But so do bad habits! They don't happen overnight - you have to really do a lot of work or repetitions in order to acquire bad habits! And once formed, they're in there forever!"

Still wondering what the big deal is?

I have "Learned" some very bad habits that are still appearing in my trading. They have surfaced with a vengeance these last few days. I'll have to correct these or I'll not be able to finish my transition to a profitable trader

- I started by questioning my new signals as I was attempting to define a new trading edge.

- while in simulation mode, If I missed an entry I would Sim a late entry as a lazy was to "log" the trade.

What Does This Mean to My Trading

Simply put - Don't chase missed entries. Wait for the next entry. More often than not, the next entry will even provide a better entry price then "jumping on" late to a missed signal. This is my number one priority right now.

Technically I should never chase. If I'm following and "Trusting" my signals I should be catching several nice moves when they are offered. The only time I can allow myself a "late entry" is when price is coming out of congestion and is giving every sign that it wants to run away. Just don't force these entries.

Trade Wise, Trade Well

John

Wednesday, May 16, 2007

Bullied Around

How Did It Go

Well... At first I felt a little bullied around by the market. With some light volume periods, the market seemed to bob around more on me. As the day went on, I started to realize that I was the bigger Bully. I was being my own worst enemy and beating myself today more than the market was beating me.

For some reason I would question my entry signal and not take it. Then I may even not take the next signal on the same trend move. Then I fell into bad habits. Too many trades. Worse yet, too many of the trades were "jumping on late" in a move where I had little hope of capturing much profit. Actually trying to hold onto these trades often ends up being small losses instead of winners.

Yet for some reason I I can get into a mode where too many of my trades are like this.

Summary Trade Review

Here are some thoughts from the notes I typed throughout the day.

Initial probe – My initial trade was best described as a probe for market direction. It was a long trade based on a new setup that I'm still working on perfecting. The signal quickly informed me I was wrong. By acting quick I was out for only a couple of ticks loss.

Lets try that again - Only short now. I missed the Declining issues making a lower high and turning down. If I saw that sooner and acted on it, I would have taken +1, +1. I missed, and slightly did not trust the re-entry at 1511.00 and I’ll take my do over on that trade. Then lets not talk about my favorite blow a trade @1509.00 price level. How many posts reference a trade I should have taken at 1509.00?

Revenge Trade – Don’t do it, walk away. Do anything other than a revenge trade as they rarely work for positive results. To make matters worse, my short at 1509 is also classified as a counter trend trade by my measure of short term trend direction. :-( I should also have seen the 1 minute buy volume at 10:32 CT as a big warning too. What was I thinking, oh... that’s right you don’t think right when you put on a revenge trade. Well there is a loss for all those 1509 trades that would have been winners. I bailed as fast as I could on this one, but damage done as the market took off FAST to the up side.

When price had troubles getting below 1506, I should have bought. I had that area as the prior weeks Value Area Low and flagged as a high importance area. Also NOTE – The low at 1506 was 1 tick away from the low defined by twice the price range created by the first hour of trading. Hmmm… Still trying to figure out how best to profit from this occurrence. Any thoughts or ideas let me know.

Saw that one coming – Saw what I figured would be a fake double top. Price action did press higher and I got short on my entry confirmation. How ironic, if the market puts in a fake double bottom at 1509. So tempting to take 2 points here, but I still like the short side right now. We will see. Well... when I started seeing more sustained buying on the up ticks than selling on the down ticks, I should have exited the second half @ +1.5 points. But price did not seem to want to go higher. So I felt price could go either way and I tried to hold on. After price stated bumping into 1510.25 I waited for the Bids to dry up and then covered for +1 point.

On non-trend days, like I'd classify the morning trading for today, I have had really good luck fading the NYSE Tick extremes. The morning High above 1513 @ 9:14 CT, then the low that touched 1507 @ 11:44 CT are good examples of these trades. I feel these are examples of when the Market is probing for stops and trying it's best to force people, you and I that is, out of trades that favor the direction the market is going. Why did I not try a long above 1507? When the market had no troubles powering to a higher high I should have been only taking long trades from this point on.

I was lulled into losing track of this important detail. The market consolidated for over an hour to help me lose my focus. I'd have to admit that the market did "it's job" on me today. That is to keep me looking the wrong way and not "seeing" what the plan is.

It is always easy to see in hindsight, but I had what I classify as 4 "Must try" long signals in the consolidation period. But doubt and hesitation chopped me up instead. Properly executing my plan, I would have capture no less than 1 point on each of these trades.

Lessons Learned or Still needing to Reinforce

Too many to list today. But I'll give it a try.

First and foremost is to trade my plan. I have only given hints so far in this blog as to the triggers for my trades. If you have not reviewed any trades in detail, I'd have to admit that this is a very aggressive trading style. When I screw up like yesterday and today, it can really hurt profits.

I pulled back yesterday, but today I'm down in more ways than one. Down about how bad I followed my system and down in the P&L too. I must just blindly start taking my trades, no second guessing. This is leading me into the the "missing out" feelings that eventually get me to "jump on" near the end of a move "Hoping" that it keeps going.

My purpose for this blog is to get the "Hope" out of my trading and stop using "Hope" as a trading discipline.

One other item I noticed about my trades today. I have two options for the second half of my entry.

- Grab Maximum profits for the "Swing" I'm trading.

- Be willing to risk the second half profits in order to hold for the "bigger" move.

- Entry Price - How good is the entry price. Expect the market to test most prices at least once. Often before a bigger move, it seems that the prices are tested two, three, or more times.

- Support and Resistance - Are there any "key" levels near by that price may react off of that could bounce price back to entry. This includes: Pivot levels, Market Profile Levels, and recent highs and lows (for today, yesterday, and overnight as well)

- Price Action - Choppy day or trending day

- Volume - Is volume increasing in the move or decreasing. Expect counter trend moves to occur with lower relative volume.

Today I think I got too caught up in the immediate price move and did not "step back" often enough to make sure I was not losing sight of the big picture. I also had troubles "trusting or believing" the bigger picture when I should have "blindly followed" my system to execute my plan.

To put it simply, maintain discipline and trade the plan. No second guessing.

Trade Wise, Trade Well

John

Tuesday, May 15, 2007

What a Day

Summary Trade Review

I got off to a really bad start today. The first couple of trades I wanted got away from me. The first was an early short at 1511.00 within the first 15 minutes of the market being open. Then I was really interested in a long near 1509.00 to 1508.00 area. You may remember the 1509 area from earlier posts. I have let too many trades get away from me that were in this area.

Well... To make up for mentally missing these trades I started trying to call the top. I quickly dug a pretty big hole for myself.

I eventually saw the light and got long at 1514.00 shortly after 9:00 CT, not a preferred entry, but better than trying another short. The market quickly went a point in favor and stalled. I took the first half off as this was not a "good" entry price and had a high probability of hitting my stop even if the market continues higher. I got lucky and harvested 3 points off of the second half.

Believe it or not, but I'm still in the hole. :-(

Then I went for a short at 1518.00, I should not, but the signal was too good not to try. The market tried to get me to bail, but I held on. As a counter trend trade, I took the first half off at +1 point, then I captured 2 points on the second half. Hey... I'm back positive on the day, but need to pay commissions still..

Then I got stupid again, took some "poor" signals. Both a long and a short and dug back into the hole again. This exchange made me miss the second drop just before 10:00 CT. I did catch the pull back and scalp a point back to the swing low around 10:12 CT.

Then I felt the need for a couple more "dumb" trades. I really need to stop this to get somewhere, other than back into the hole again that is.

I stood aside for a little while to better figure things out. Hey, I think I figured it out, we are going back down. So I doubled the contracts. the bad news is I did not get a "good entry" again, I'm short from 1513.75 on the Jump-on entry.

I tried to hold on to all the contracts. As price approached the 2 point target for the first half position, I moved the stop to 1 point to make sure I harvested no less than that. Well, the stop took the first half off at 1 point. For 1 minute, price touched the +1 point stop but went no higher. A looser stop would have allowed more profits. :-( The second half was bumped out at +2 points. All on double contracts. I would have been done favor the day at a max stop loss if I was wrong on the direction. There were signs earlier to get short above 1516, but my head did not clear fast enough.

Had a couple more trades where I lost a little and then made it back. Saw what I thought was the "next ledge break" forming after 1:30 CT. I decided I needed to stop as I was getting "too wild" with my trades.

How I felt

I think I revenged traded early today. I can tell you that it did not help, and I'm sure I can say that it hurt in several ways.

- Making bad trades starts to wear at your confidence.

- Then you start questioning the next signals when you should be reacting to them.

- Breaks your Discipline and snow balls into more bad trades.

- Get some bad trades that eat into profits (or make losses)

- May get some winning trades, but entry is later in the move and not a level that can easily be held for larger profits.

Lessons Learned

Too many of my trades today were of the "jump-on" variety. This is where I see a move starting and I try to join it as early as possible and risk that price may make another stop run higher or turn and reverse directions. I have two stop choices here.

- Tight, will be hit if price does not reasonably continue.

- Loose, Risking a larger loss if I'm wrong on the price direction.

While several of these trades worked for nice profits, many others also produced losses that made today not very good of a day. Since price kept moving today I was able to "earn my way back" again. Without these moves, it would have been a different story.

I did figure out some signs using the Volume Break Down Delta, or difference between trades on up ticks minus those on down ticks, that helped me stay in some of my winning trades and should have had me bail on the position that turned into losers. I may end up doing a post on that sometime by itself. I'd classify it as more of a scalp entry where some profits would need to be "taken off the table" to lock in profits and additional contracts could be allowed to run for more profits.

Trade Wise, Trade WellJohn

Monday, May 14, 2007

Interesting ES Fact for Today

I forgot to point out one interesting item in my trade review today. This happened in today's price action, but don't get real excited as this does not happen everyday. I'm trying to study it and see what I can discover.

The Low of the Day came in, to the Tick, at twice the range of the price action within the first hour of trading. Above is a 5 minute chart of the ES emini. There are three bands on color that show on the chart behind the price action.

- The narrow green band, is a 32% to 68% range of the first 15 minutes of trading. I use it to help me determine early directional trades.

- Wide green band - represents the price range of the first hour of trading.

- Blue Band - Twice the range of the first hour of trading.