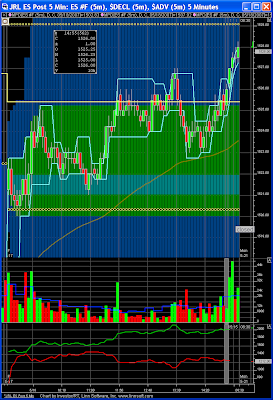

Today went great. I was doing "my fatherly duties" today and did not have much real-time chart watching. So it was good to spend some time with the family and get a break from the charts. Here is a 5 minute chart to review how the day went.

I was around to see the market open. I was trying to decide if I was going to take any trades today knowing that I'd be away from the screens more than I'd be able to monitor the price action and my trades.

I don't have many entries right off of the open. My setups rely on current price action and sentiment to develop before I fell I have a high probability trade setup. I was really interested in shorting 1522.00 just off of the open, there was a nice pattern in my Volume Break Down Delta telling me to go short.

The trouble is that this pattern can quickly flip back to the long direction so I like to see some price action to go with this signal to be more confident I'm entering with the trend and not just catching a quick retracement in price.

I did short at 1521.00 to probe and see if the initial down trend was going to continue. My first half did not fill at +1 point. I knew there was a 9:00 CT report coming and my objective was to try and have a "free" trade with the second half of my position in case price breaks hard down from the report. When price stalled, I took half off at 0.75 points or three ticks. Normally I would have held, but since I had to leave before the report hits, I made a compromise. I needed to get out the door and price was starting to inch up at me so I placed the stop at break even and left. I was confident that the stop would be hit just a couple ticks way from price. Maybe I should have just closed the trade. Either way there was not a big difference.

From this point on, I had just a couple of times where I had the chance to "check the charts" to see what I had missed out on. Each time I looked it seemed like I had just missed my entry, price was still close, but the trade was a counter trend trade.

Shortly after 9:30 CT I really really wanted to short 1525. I had a major cluster of resistance there. The R2 value I had at 1525.50, I had a Market Profile Target at 1525.00, and a second possible Market Profile Target at 1526. We just have to get enough of a bounce off of this price area for a small profitable trade.

I should have noted the entry price I could have grabbed as I sat down to the screens. I passed and watched as price did work its way lower then channel tight sideways before I was off again. This trade should have been good for 2 points and 2 points for each half the way I trade.

This time I was gone longer than I expected. I returned just before 1:30 CT. It was a quick read, but I could still get short just under 1527. I decided that I have a bad track record for trades I "instantly" identify at first glance after being away from the screens for a period of time. Passed again. Another possible 2 - 3 points

The afternoon looked like it could be flat to slightly higher. Well... make that a close at new highs for the weekend hype. Should have thought about that, but decided just to observe.

Lessons Learned

Don't over do it - make sure you get some time away from the charts every now and then. I think I was over due for a break.

Observations

Another choppy day. The price action yesterday had better defined "micro trends" on the 5 minute chart as defined by the light blue lines around the price action. Today had consolidation periods where the "upper trend line" went lower and the "lower trend line" went higher.

Today seemed easier to trade, but did not offer the same profit potential. Granted I was not there is real time like I normally would have been. Let me know what you thought trading the ES was like today. Did you stay awake and focused through the consolidation to catch the moves?

Trade Wise, Trade Well

John

No comments:

Post a Comment