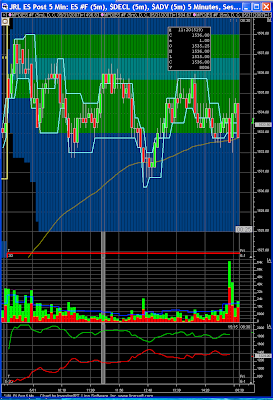

Monday 5/14/2007 ES Futures

How it WentGood Start, then all down hill from there.

Price action covered a 14 point range and never hit R1 or S1 due to the large range last Friday.

I was left standing trying to figure out how I could be both too aggressive and not aggressive enough all at the same time. Well, that is how I feel about today’s trading. I felt good about most the trades I took, but two bad trades and some bad stop management cost me having a good day today.

My Trades

My Trades

Trade Pos. Enter $ Exit $ Enter Time Exit Time Result

1A Short 1512.75 1510.75 5/14/2007 9:09 5/14/2007 9:20 2.00

1B Short 1512.75 1510.75 5/14/2007 9:09 5/14/2007 9:28 2.00

2A Short 1510.50 1511.50 5/14/2007 10:32 5/14/2007 10:38 -1.00

2B Short 1510.50 1511.50 5/14/2007 10:32 5/14/2007 10:38 -1.00

3A Short 1511.75 1510.75 5/14/2007 11:51 5/14/2007 12:21 1.00

3B Short 1511.75 1511.50 5/14/2007 11:51 5/14/2007 12:26 0.25

4A Short 1509.50 1507.50 5/14/2007 12:36 5/14/2007 12:45 2.00

4B Short 1509.50 1508.00 5/14/2007 12:36 5/14/2007 12:47 1.50

5A Long 1503.75 1502.75 5/14/2007 13:17 5/14/2007 13:18 -1.00

5B Long 1503.75 1502.75 5/14/2007 13:17 5/14/2007 13:18 -1.00

6A Short 1505.00 1506.00 5/14/2007 13:27 5/14/2007 13:29 -1.00

6B Short 1505.00 1506.00 5/14/2007 13:27 5/14/2007 13:29 -1.00

7A Long 1505.25 1504.25 5/14/2007 13:38 5/14/2007 13:43 -1.00

7A Long 1505.25 1504.25 5/14/2007 13:38 5/14/2007 13:43 -1.00

My Take First Half: 1.0 Point Second Half: -0.25

I feel I could have/should have captured 7 and 5 points today (or more). With my same trades above, just better stop management would have made all the difference. Add to that another 1 point for each "half" just for me to not take a "stupid" trade.

Trade Narrative

I started out not aggressive enough. I was looking at a possible short at lasts week’s Value Area High. Short 1515.50 plus or minus. I backed off when price sliced through almost 1 point. This area was also a retest of the overnight high. Ended up being the high of the day.

My next short signal was just under 1515 and ran away from me as I waited for what I'd classify as a clearer signal.

1. In a Trade - In early at 1512.75 as I used a signal that formed within a 1-minute candle. At the close of the candle the signal was “not as good” as intra-bar. But the trend is continuing and I did not take much heat.

I took the first half off at a standard 2 points profits as that was a little above the Value Area High from last Friday. Almost did not take 2 points on the second half, but when it appeared that we would not get initially through Friday's VAH I took 2 and ran.

I passed on the next two short signals. The first would have been a scratch trade, but the second would have captured 1 - 2 points each half.

2. First stupid Move - Tried to "short the negative Ticks as a "go with" the trend trade. I held too long and even had a late chance to bail at break even and did not take it. I either should have not entered this trade or I should have bailed much earlier when there was not follow through.

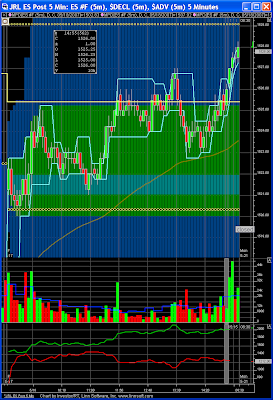

3. Good Read or Lucky - You will have to decide for yourself on the title. I was too aggressive on the entry, I had all day to get short at 1512.00 and just went short quickly a tick lower. I had to hold on for 25 minutes for the trade to go somewhere. The 1000 Volume and the 233 Tick charts helped me hold on to this one.

This is BAD STOP placement 1. For some reason I placed the stop at BE + 0.25 for the second half. Well I have to say it, but I was out TO THE TICK at the swing high. To make matters worse, I think getting stopped out and having to re-enter the trade at a lower price kept me from getting back into the trade.

4. Jump On - I did jump back on as it looked like we were tipping over. Price came back a tested my entry and I held firm. I took the first half profits at 2 points again. Something possessed me to get aggressive on the stop for the second half. I wanted a better rally to get short off of again. But if did not come. I missed another 3 - 4 points by not just holding the prior trade longer.

5. Really aggressive - Having missed out on the Short side, I decided to take an aggressive long signal. I felt strong that we had a good chance of making a bound here. The problem is that I got too aggressive with the stop placement too. BAD STOP placement 2. Out to the Tick again, and the trade is working. :-( If I have waited for the close of the 1-minute candle I would have entered at a better price and believe I would not have been stopped out. I must give a wide stop when entry price is not ideal.

6. Extra Trade - If the long position would have "stuck" I'd be long and would have passed on this short trade. With the strong Buy Volume, I should have passed on this trade. Tight stop, but another looser. :-(

7. I did it AGAIN - Liked the long again, but the darn stop got too close again. I can not believe this is the third BAD STOP placement for the day. Out to the Tick again. on another trade that would have made some profits. That hurts, again.

Thoughts About Today I killed my profits today. Two "mistake trades" that I should not have taken hurt, but what hurt the most was having two long trades that I was “right” about, but an extra stop run took me out to the Tick. Granted my stop was too tight as well, but that hurts the pride.

Lessons Learned - Or still needing to reinforce

Sometimes it can pay to get aggressive. I have felt that I have been passing on a lot of opportunity by trying to primarily take signals with the trend. I got aggressive this afternoon as I "missed too much" of the move with the trend.

The lesson is that I should not get too aggressive with my Stop Placement as that rarely pays. My usual line is not to move your stop until you are willing to get taken out of the market at that price. I need to listen to myself sometimes.

Trade Wise, Trade Well

John