How did Today go

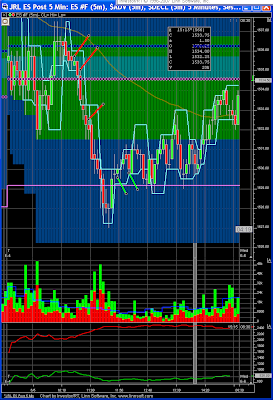

Today was not a banner day for me. I ended up positive, but I definitely needed to take some "Blind Faith" trades to make today deliver the results I would have expected for today. I had four occasions where I found myself saying I should be in a trade, but ended up watching anyway. See the Red lines (first two) for short trades and the green lines for long trades.

I think I'm being overly judgemental about my entries. Last week I found myself chasing price after taking too long to decide that a signal was good. When the market is not trending, chasing a price swing ends in a scratch trade 80% of the time and that requires me to "give up" on the trade before price retraces and would often hit my stop for a small loss.

I'm also trying to press myself to take the signal at the "right time" or to let the trade go after reading Dr. Brett's comments about the replies to his Coaching Project and today's Discipline post. If I had to place myself in one of the categories Dr. Brett describes in the Discipline post it would have to be the volatility category.

It feels weird to me to say the cause to my discipline breakdown is volatility. But I can make an association. The signals I'm passing on too often are tight coils where price often moves sideways for 10 to 15 minutes. Today's first short example fits this to a tee. Price went down 9 of 10 points before we had a rally of more than a point. I had several "confirmed short" signals but passed as I always felt I was shorting the low.

I think a mental association with shorting the low is more apt to be the cause. I feel I built this association by "chasing" entries late. Since price often moves in surges, a late entry will more often then not comes at or near the next "counter trend" signal in my system. Then price usually retraces enough that I have a hard time justify holding on to these trades. On a choppy day, these surge moves are often the head face before price turns back into the chop.

But now I'm in a catch 22. My discipline problem is caused by a discipline problem... Err, lets not go there.

I will say watching the 5 minute volume helped to keep me from taking some counter trend trades. Starting with the first Red candle of the down trend (just before the second high in the double top) at 10:10 CT we had light volume followed by an increase in volume as the trend started down. Then the 10:20 CT candle had lighter overall volume, BUT note that the "Sell Volume" as indicated by the Red portion of the volume bar increased from the prior bar even with the lighter volume.

This afternoon, I found Volume to be a much harder read.

Trade Wise, Trade Well

John

2 comments:

John,

This post states the exact problem that I have. The only thing I can think of is finding volume patterns in markets making a second or third leg down. If there you know how to read the potential second leg down, then shorting the bottom of the first leg down may not be so painful.

So far it's been hit or miss. Sometimes I short/buy breakouts really well, but lately I have been shorting the intraday bottoms. Fortunately the scaling out trick from trading in the zone has saved me but, making 10 cents a trade on 300 shares before comissions is hardly and "Edge".

So, I'm considering laying of the base breakouts/breakdowns and just focusing on price retracements on low vol after a temp bottom/top of what is hopefully just the first leg.

I look forward to reading more and hope to learn more about these patterns.

Hi FlatWallet,

Sounds like we have a fair bit in common. If you look closely at my entries, I'm actually entering where I feel the retracement top is being put in. I do not wait for the breakdown to enter.

At this point in time I have not disclosed how I measure and try to judge when the market is returning back to the trend.

I have to be careful with the counter trend trades. Sometimes these are accidental when I'm trying to short a "second leg" but the market actually decided to turn back higher instead.

I'm watching my 5 minute "relative volume" as a big help in this area. Volume naturally dies off in midday. I look for lower volume on the retrace and think I just need to force myself to "try" the next signal when the retrace volume is light. It has worked more often than not.

Other times I'm getting too aggressive and after missing or not trusting the prior leg down, I'm trying to ride the retracement higher until the next short signal comes in to "catch back up" on missed profits. Too often I end up buying when there is little to no retracement and may miss the next leg down in addition to my breakeven or small losing trade.

I also scale out of my positions to lock in initial profits. I try to hold for 2 points on the first half, but depending on how price is behaving often settle for 1 point in the ES. This makes it easier for me to allow a retrace to breakeven and still hold the second half for the longer run when available.

Thanks for the comments.

Trade Wise, Trade Well

John

Post a Comment