How Did it Go

Better, but still not where I want it to be for a day like today. I caught a couple of the down swings and actually make some profit on a couple long trades too. But I still can do better. As weak as the NYSE Tick was today, I should have shorted anything that even looked like a top.

Why was my game still off today. The price action felt jittery or jumpy to me most all of the day today. I seemed to get transfixed with the jumpy price action and did not focusing on all my tells like I should. It started when I just missed the rocket ride to the long side early in the morning. I took me over an hour to adjust and get a good feel for today. Then I still felt a step behind on many moves.

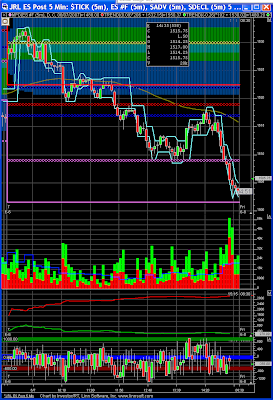

This is a little hard to see in the 5-minute chart but try to follow along. We start by looking at the double top between the 8:50 CT and the 9:05 CT candles. The 5-minute chart then hides the pull back as it is split between the 8:50 CT and 8:55 CT candles. Leaving both 5-minute candles looking Green or up moves.

But notice the volume after the first top. Big drop in volume and reduced again in the 9:00 CT push to the second top. What you did not sell the top, there was 5 minutes to sell 1532.00 or better. Well I saw it, and decided not to trust that signal as we already shot up 4 points on almost unbelievably weak NYSE Tick readings. I added to the 5 minute chart for reference.

Normally I'd expect to see NYSE Tick readings touching the green horizontal line in the chart for price to move significantly higher. See how the first near touch at 13:30 CT started the afternoon long trend.

Next, the 9:15 candle's volume screams short the next turn down. I should have taken it, but the NYSE Tick was so weak that I was waiting for a slight push higher before I shorted. My Volume Delta indicator tried to tell me that was all I was going to get for the move up. I was still trying to get in sync with this very "different" day.

Trade Wise, Trade Well

John

No comments:

Post a Comment