Just before a "Big Move"The following charts display two examples from today's (June 7th, 2007) price action that I'm always trying to be on the lookout for in price action. I have to say I'm just beginning to trade them properly.

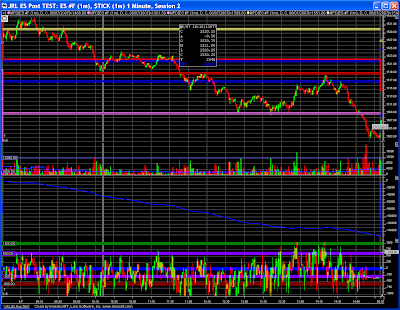

Well get to it alreadyJust before the big moves are made, the market does the best it can to shakeout and fake out as many people as possible. I dialed into the 1-minute chart to show more of the price action.

What Do You Mean by That

What Do You Mean by That

Notice the nice methodical "Stair Step" down pattern was from the double top high after 9:00 CT down to what could be a double bottom low at 1527. The second low comes in right at 9:30 CT. Then the market moves up above 1528 and does a head fake lower to get some more shorts to jump in.

Then there is an abrupt detour in the down trend and price drives straight higher. We make another top at 1530.50 price. I'm actually surprised that we did not go at least 1-tick higher as I'd expect some people had stops above the prior 1530.50 high. Enough people must have moved their stops to 1529.50 area. Would your have left your stop 4 points above and stayed in this down move?

Then note what happens on the way back down. Price hesitates at 1529 for those people that want in of this "up trend" we just had. Then price presses a little lower. The people long at 1529 are now "hoping" for price to come back higher and I'm sure a few more people get long at this "better price" before price is crushed down past the prior lows.

Also Note

Be sure to note the high in the NYSE Tick when price drives back up to 1530.50 just before the big drop. The Tick made a "higher high" when compared to recent Tick highs. This could mean a turn back higher, but also often signals the big "stop run" before a return to the prior trend. It is our job to figure out which one is being signaled.

Another One

Another One

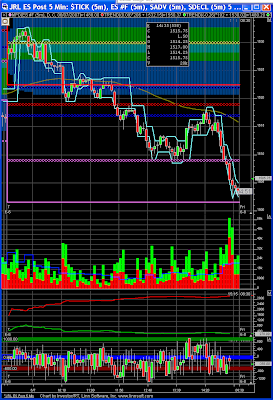

Look at how complex the bottom is before the market goes nearly 10 points higher. The first low is 1509.00 at 12:42 CT. Then we have step one higher to 1512.50 at 12:47 CT follow by the retracement down to a potential "higher low" just missing 1510 at 12:49 CT. Now notice the 12:51 CT and 12:52 CT candles. A quick slam down and back up again for anyone wanting to get short as there has not yet been a "higher high" yet that may keep some people from getting short.

Price grinds higher to the 1513.50 high after 13:00 CT. Then the move down seemed to me to be a pop up in price followed by a quicker slam lower until we made a lower low. Then price went up 2.5 points, back down 2 points, up 2.25 points, back down 2, and then up 3.25 points. In this big of a down day, who would hold through all of that to catch the long move higher? I did not play in any of that chop.

Look what happened next. Price comes down 3.5 points. 1 Tick lower the the last of the three lows described above. I tried to to get long this last time down.

You What?

I tried to get long at 13:36 CT. If you look at the 5-minute chart, the 13:35 candle had lower over all volume. Call me crazy, it looked like I should try it. Well I did not get filled. Looking at a faster chart (not posted) price dipped below 1510.00 @13:36:23 CT, touched 1509.00, and was back above 1510.00 at13:36:38 CT. I had 15 seconds to place my order. Actually I tried for 1509.50 and price was only below for 5 seconds. I could have gotten in at 1510.50, but that is where I would have taken off my first half trying to let the second run for more profits. With only a few hesitations for people to get short at, price drove straight up 6 points.

Hope that makes sense. Let me know if I should mark up the charts more and what you would like to see as mark ups to help better describe the price action.

Trade Wise, Trade Well

John

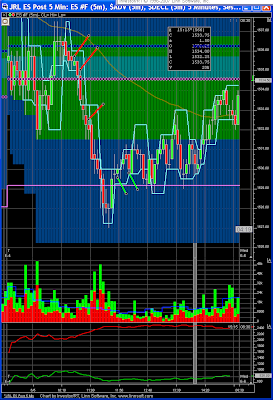

Other than the differences in the values, I do like what I'm seeing from this indicator. More historical research is needed to see how this reacts in different market conditions.

Other than the differences in the values, I do like what I'm seeing from this indicator. More historical research is needed to see how this reacts in different market conditions.